| Price, cycle and rarity on the raw materials market: |

The scope of my accreditation to direct research (HDR) covered fifteen years of research at IFPEN on raw materials and market price formation mechanisms, with a specific focus on the short-, medium- and long-term dynamics. This work was partly informed by research conducted within the framework of the ANR Generate (Geopolitics of renewable energies and prospective analysis of the energy transition) project, which I led between 2018 and 2020.

Trois contributions illustrent la démarche que j’ai adoptée.

Three contributions illustrate the approach I adopted.

Against a backdrop of global economic and geopolitical transformations, the first of these focused on revisiting the long-term factors that can influence oil prices and the principles of coordination between players. To this end, it examined the influence of the Organization of the Petroleum Exporting Countries (OPEC) on markets as a function of the different price regimes observed since 1970, using various econometric methodologies (co-integration, Granger causality, panel data analysis, etc.) [1].

The second contribution focused on the relationships between financial markets and short-term price dynamics by estimating a Markov chain model with regime shifting1. The analysis specifically related to the relationships between the Spot and Futures prices of WTI2 in the USA and highlighted the role of speculation, particularly during the financial crisis of 2007-2008 [2].

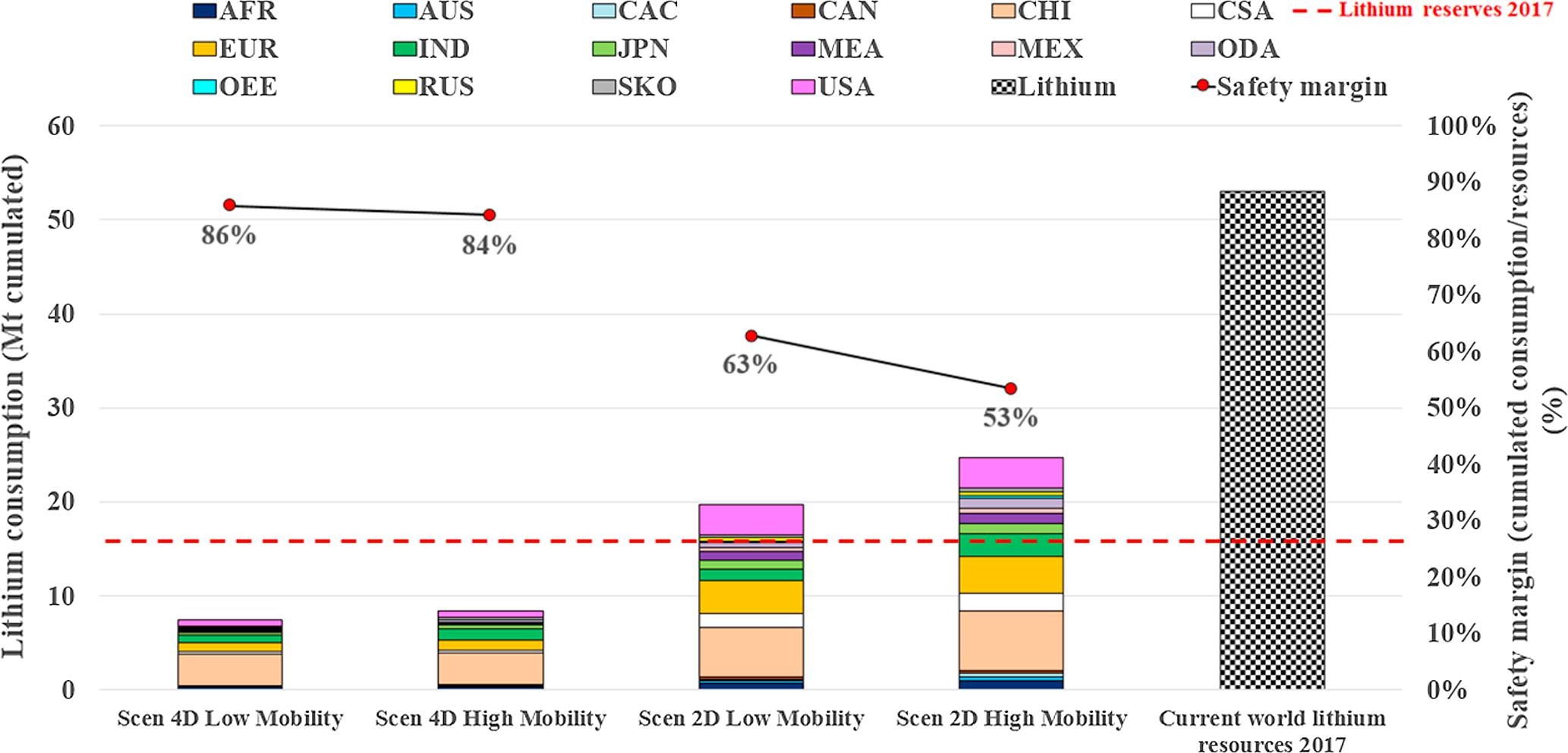

The third contribution covered the evaluation of the criticality of raw materials present in low-carbon technologies using the TIAM-IFPEN model. This research highlighted the soaring demand for these resources, and the importance of water, through the modeling of value chains for materials such as bauxite, cobalt, copper, lithium, nickel and rare earths. Taking lithium, for example (figure), for a scenario of +2°C with stable mobility, an increase in consumption of this element representing 47% of resources over the period 2005-2050 can be observed, i.e., a reduction of the safety margin to 53%, compared to 63% with mobility changes [3].

1 Type of model employed by economic research organizations to analyze the business cycle

2 West Texas Intermediate (WTI) is a grade of crude oil used as a benchmark in oil pricing.

Obtaining the HDR has enabled me to consolidate my academic credentials and develop new research projects, including the ANR Get More H2 project (Energy Transition Geopolitics and Global Economic and Social Modeling of Hydrogen Production Technologies), which runs from 2023-2027, in partnership with the CEA (French Alternative Energies and Atomic Energy Commission), Paris-Nanterre University and IRIS (the French Institute for International and Strategic Relations), and which I am coordinating.

References :

- Bremond, V., Hache, E., Mignon, V., (2012). "Does OPEC still exist as a cartel? An Empirical Investigation". Energy Economics, 34, 1, pp.125-131.

>> https://doi.org/10.1016/j.eneco.2011.03.010

- Hache, E., Lantz, F., (2013). "Speculative Trading & Oil Price Dynamic: A Study of the WTI Market", Energy Economics, 36, pp.334-340.

>> https://doi.org/10.1016/j.eneco.2012.09.002

- Hache, E., S., Seck, G., Simoën, M., Bonnet, C., Carcanague, (2019), "Critical raw materials and transportation sector electrification: A detailed bottom-up analysis in world transport", Applied Energy, 40, pp.6-25.

>> https://doi.org/10.1016/j.apenergy.2019.02.057

To know more : Emmanuel Hache