30.01.2025

15 minutes of reading

Summary:

- Biofuels in the road transport sector

- Gasoline substitutes

- Diesel substitutes

- Biomethane for NGV powertrains

- Spotlight on biofuels in the aviation sector

- The emerging role of biofuels in maritime transport

- Focus on France

- Outlook for carbon neutrality

- Investment outlook

- A stronger position for biofuels in medium/long-term scenarios

Biofuels in the road transport sector

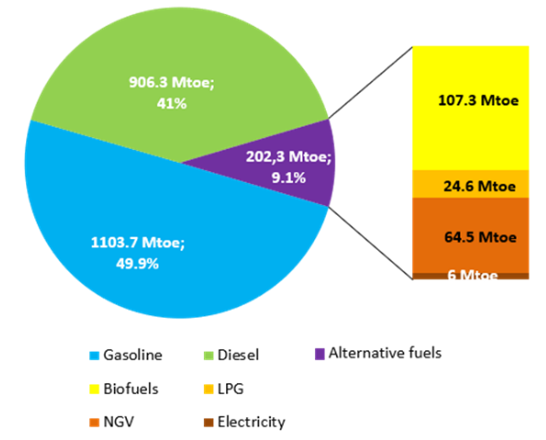

In 2023, global energy consumption in the road transport sector amounted to just over 2.2 Gtoe, representing an increase of 3.2% compared to the previous year. This means that it will have taken 4 years for global consumption of road fuels to exceed its pre-COVID level (2.17 Gtoe in 2019).

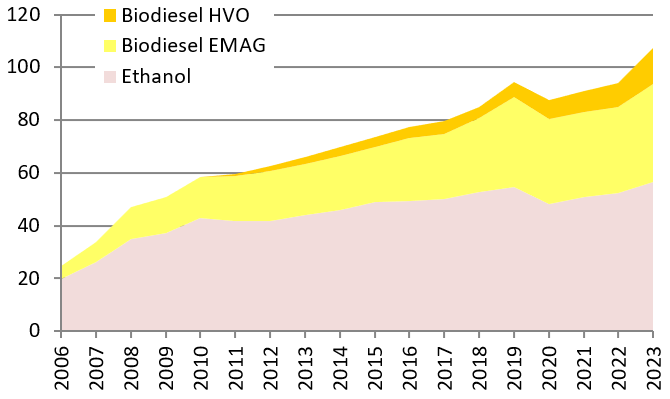

The share of alternative energies to oil-based gasoline and diesel fuels (biofuels, LPG1, NGV2 and electricity) is also up by 3.2%. In 2023, it represented more than 9% of the fuels consumed, i.e. nearly 200 Mtoe, the highest level ever reached. Among these alternatives, biofuels accounted for 107 Mtoe, i.e. a market share of more than 53% of these alternatives and 4.8% of all fuels consumed (Fig.1). The incorporation rate for biofuels in road gasoline and diesel reached 5.6% in 2023 (compared with 5% in 2022), driven by growth in overall demand for liquid fuels and double-digit growth in biofuel consumption (+14% between 2023 and 2022) for the first time since 2010 (Fig. 2).

Source: IFPEN, from Enerdata and S&P Global

Out of the road transport biofuels available for consumption in 2023, bioethanol or fuel ethanol, the main substitute for gasoline, recorded annual growth of 8%, compared with 3.2% growth in demand for oil-based gasoline. The global consumption of ethanol thus reached 56.7 Mtoe in 2023. As for biofuels that replace diesel, they are back on track with pre-COVID trends, with growth of nearly 22% and record consumption of 50 Mtoe worldwide (Fig. 2). From a technological standpoint, this momentum in the biodiesel market is largely driven by the growth in demand for HVO (Hydrotreated Vegetable Oil), estimated at +50% between 2022 and 2023. However, there is renewed interest in FAME (Fatty Acid Methyl Ester) which has shown growth of nearly 14% (compared with +0.7% between 2021 and 2022).

Source: IFPEN, from S&P Global

Across the continents, the incorporation rates of all biofuels into road fuels have risen. They vary depending on the region, but Latin America still has the highest rate (over 11% in energy terms), thanks to the Brazilian ethanol market, which alone reaches an incorporation rate in gasoline of close to 40%. North America and the European continent follow, with respective rates of 10.4% and 5.7% respectively. In Asia, this rate has been rising every year and reached 2.7% in 2023.

In the European Union, after a sharp upturn of +13% between 2021 and 2022 in the wake of the health crisis, consumption of liquid biofuels remained virtually stable at around 17 Mtoe (and 19 Mtoe on the European continent as a whole) in 2023.

In South America, pre-COVID growth momentum seems to be gathering pace again, with consumption on a par with 2019 (nearly 23 Mtoe) as well as ambitious prospects especially in Brazil. The strongest growth in consumption between 2022 and 2023 was seen in North America and Asia (+15% for 44 Mtoe and +21% for 18 Mtoe respectively).

Gasoline substitutes

Gasoline substitutes

Since the emergence of the biofuel market, ethanol has remained the primary substitute to gasoline fuels used around the world. Worldwide, the growth of its consumption has been estimated at +8% between 2022 and 2023.

.png)

Source: IFPEN, from S&P Global

The United States continues to be the biggest producer, followed by Brazil. The two countries alone account for 82% of the global market. However, it was in Asia-Pacific that the rate of growth in production was the highest at over 17%. India, China and Thailand account for 94% vol. of the Asian market, with India showing particularly strong growth in 2023 (+27%).

In Europe, demand for fuel ethanol continues to grow, driven by the take-up of SP95-E10 and super-ethanol E85, particularly in France. France and Germany currently consume over 50% of the fuel ethanol incorporated in the European Union. Poland, Ireland and Austria have recently introduced the use of E10, while there has been an increase in the incorporation of bioethanol in Spain, Belgium and the Netherlands, mainly due to the growth in gasoline stocks. In response to this demand, European bioethanol production and import levels rose in 2023 (+3 and +12% respectively).

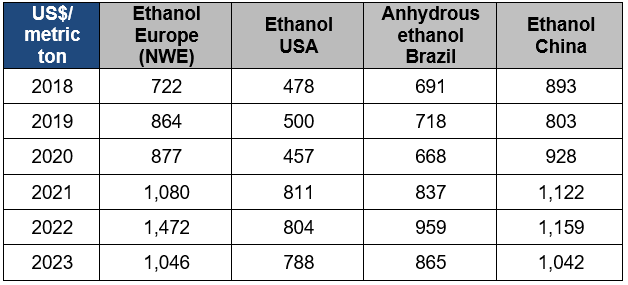

After the inflationary spike of 2021-2022, energy prices, and in particular natural gas prices, began to decline, which had a direct impact on ethanol prices. The increase in the supply of electricity from other energy sources (renewable energies and nuclear power) and investments in liquefied natural gas infrastructure have all contributed to lower European prices. Nevertheless, the competitiveness of European ethanol is under threat, and this was already a critical issue during 2024.

Source: IFPEN, from Argus

USA and Brazil rank as world leading ethanol exporters in response to rising European demand. Since 2021, with the upturn in post-Covid activity and a particularly competitive market price, ethanol exports from the United States have seen double-digit annual growth rates, particularly to Canada, and to a lesser extent to the United Kingdom, the European Union, India, South Korea and a number of Latin American countries.

Diesel substitutes

Diesel substitutes

Two main biofuels are currently incorporated into the road diesel fuel pool: FAME and HVO. They use biomass resources that contain fatty acids mainly derived from oilseed crops (rapeseed, palm, soybean, etc.) or used cooking oils or animal fats. Unlike FAME, the incorporation of which is limited to a maximum of 10% vol. in diesel distributed at the pump in the European Union, there is no limit to the amount of HVO that can be incorporated in the mix. The youngest industry, but one that is enjoying strong growth, HVO represented 27% of biodiesels consumed globally in 2023 (compared with 22% in 2022) (Fig. 2).

Historically, the biodiesel market has dominated in the European Union, where the majority of vehicles run on diesel, unlike in other parts of the world. Even so, since 2022, the Asia-Pacific region has become the world’s leading biodiesel producer, and confirmed its leadership in 2023 (22.7 Mtoe). While it is also the top consumer of FAME, almost all its HVO production is destined for export. Furthermore, in 2023, total biodiesel consumption in North America equaled that of Europe (15 Mtoe) for the first time. This makes the United States the world’s leading producer and consumer of HVO (7 and 8 Mtoe respectively), accounting for over 60% of the global market.

Following the EU’s decision to end support for biofuels made from palm oil, and the relocation of the US biofuels market, Asian palm biodiesel producers have reoriented their market. Indonesia has launched an ambitious energy security program targeting 23% renewable energies by 2025, including locally rolling out B353. Indonesia, the world’s leading producer of FAME (11.9 Mtoe), accounts for over 26% of total production and 23% of total consumption. Brazil, the world’s 2nd-largest producer of FAME (6.6 Mtoe), is also showing impressive momentum, with growth of nearly 20% between 2022 and 2023. A changeover to the B12 mandate took place in 2023, followed by the B14 mandate in 2024, whereas a B15 mandate is currently envisaged for 2025.

%20production%20movements%20by%20zone%20(in%20billions%20of%20liters).png)

Source: IFPEN, from S&P Global

In terms of exports, China remains the world’s leading exporter of FAME, and especially used cooking oil methyl ester (UCOME4).

It currently has a competitive rate compared with other European sectors, and can benefit from double metering to comply with the objectives of the RED directive in force in each of the Member States. Singapore is still the world’s leading exporter of HVO.

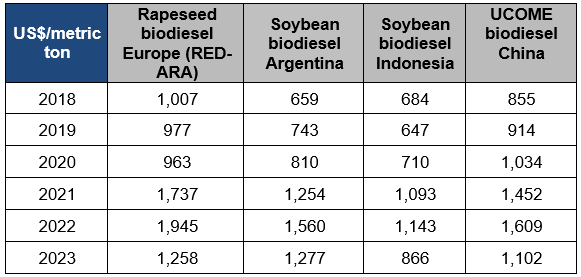

Source: IFPEN, from Argus

![Tableau 3 - Prix annuels du biodiesel HVO européens selon différentes classes de ressources [US$/t]](/sites/ifpen.fr/files/inline-images/NEWSROOM/Regards%20%C3%A9conomiques/Etudes%20%C3%A9conomiques/Biocarburants%202024/Tableau-03_TB-Biocarburants-2024.png)

Source: IFPEN, from Argus

* Class I: HVO from food crops, enabling a reduction in greenhouse gases of 65% min.

**Class II: HVO from recycled vegetable oils (UCO and POME), enabling a reduction in greenhouse gases of 85% min.

***Class III: HVO from category 3 animal fats, enabling a reduction in greenhouse gases of 80% min.

For the FAME and HVO sectors, the post-inflationary price decline has now begun. HVO still commands a price of around $2,000/t, depending on the zone, i.e. approximately 1.7 times higher than that for FAME.

Biomethane for NGV powertrains

Biomethane for NGV powertrains

An as yet minority renewable fuel, biomethane consumption is nevertheless increasing in some zones where natural gas has historically figured among road fuels. Currently primarily produced by anaerobic digestion of organic waste (methanization), or via the recovery of landfill gas, biogas is a renewable fuel principally used for heat and electricity production. Only a fraction (around 10%) is purified to obtain biomethane that is suitable for injection into the natural gas network and/or used as a fuel in dedicated vehicle engines (NGVs).

For transport, biomethane can be used in the form of Bio-GNC5, a compressed form of biomethane, or Bio-GNL6, which is a liquefied form of biomethane. Bio-CNG and bio-LNG can replace conventional CNG and LNG derivatives of natural gas without the need for any changes to infrastructure. Both fuels can be produced either directly in the biomethane production plant (on-site production), or by extracting biomethane from the grid using Guarantees of Origin (GO).

Biomethane motor fuel accounts for only 3% of renewable fuels for internal combustion engines in the European Union, but is currently experiencing strong growth (+13% in 2023). It is mainly used in the form of Bio- LNG for heavy truck fleets (80%), followed to a lesser extent by maritime transport (17%). By the end of 2021, the EU had 15 Bio-LNG production plants, and by the end of 2023 this figure had risen to 59 units. Nearly 50 additional units were expected by the end of 2024, for a production capacity of 5 TWh/year (430 ktoe/year), and a further 100 or so units by 2027. 14 European countries are currently active in the bio-LNG market. The two largest bio-LNG plants in Europe are located in Germany (140 GWh/year) and Norway (120 GWh/year). The highest production capacities are expected in Germany, Italy, the Netherlands and Sweden, respectively, by the end of 2025 (i.e. a total of 15 TWh or 1.3 Mtoe).

Bio-CNG is used in fleets of heavy trucks and lighter vehicles, and may also find use in river transport in the future. There are currently 142 production units in Europe dedicated to compressed biomethane for use in the transport sector (out of a total of 1,478 biomethane units in operation).

In the United States, NGV fleets made up of heavy trucks, buses and waste collection vehicles, have grown significantly in recent years. In 2023, Bio-NGV consumption continued to progress, with growth of 16%, in favor of Bio-CNG, which represents 89% of biomethane motor fuel consumed.

Spotlight on biofuels in the aviation sector

Spotlight on biofuels in the aviation sector

With the growing awareness of the existing environmental impacts of international air travel (which currently accounts for 13% of CO2 emissions in the transport sector) and given the sector’s growth outlook, member states of the international civil aviation organization (ICAO) adopted different global goals:

- an immediate goal of stabilizing CO2 emissions from international aviation at 85% of the level observed in 2019, by incorporating sustainable aviation fuels (SAF) or purchasing certified offset credits

- a long-term aspirational goal (LTAG) to reduce emissions to zero by 2050, without using offsets

- in addition, a short-term goal announced in 2023, aimed at reducing global aviation emissions by 5% by 2030 by using clean energies

To date, these global goals are not binding, but member state governments are responsible for drawing up incentive action plans. To achieve these goals, using SAFs is regarded as one of the principal levers for reducing emissions. There are currently 8 alternative biokerosenes and 3 coprocessed biokerosenes certified to ASTM International D7566 and D1655, including some that are already mature or close to industrial maturity, such as HEFA-SPK7, produced by HVO units, FT-SPK8, products of Fischer-Tropsch-type BtL and e-fuel processes, and ATJ-SPK9, produced by converting ethanol or isobutanol into synthetic kerosene. These alternative kerosenes are currently approved for incorporation in conventional kerosene, with a maximum limit of 50% vol. in the blend.

In 2023, 0.5 Mt of SAF were produced worldwide, i.e. double the amount produced in 2022, and the figure is expected to double again in 2024 (1 Mt). Today, the majority of the SAF market is located in North America, due to increasing air traffic and the accelerated adoption of government and federal support for technological development and product usage.

In 2023, the USA incorporated 75.5 kt of SAF (up from 48 kt in the previous year), including 36 kt from imports. To date, the annual assessment for 2024 shows a 4-fold increase in the incorporation of SAF, to the tune of nearly 314 kt. Through its Sustainable Aviation Fuel Grand Challenge, the US government has set itself the challenge of producing 9 Mt of SAF by 2030, corresponding to 10% of all the kerosene supplied by the country’s airports.

Over the same timeframe, in the European Union, the ReFuel EU Aviation initiative requires the incorporation of 6% SAF in the kerosene distributed at European airports, i.e. around 3 Mt. By 2050, the European Union should be aiming for a 70% SAF incorporation rate. From 2025, the EASA will be responsible for monitoring and reporting yearly on the movements in the EU SAF market.

In Brazil, a SAF incorporation mandate is due to come into force in 2027, with the aim of reducing the sector’s CO2 emissions by 1%, a goal that will progress towards a 10% reduction by 2037. In the Asia-Pacific region, Japan proposed legislation in 2022 requiring SAF to account for 10% of aviation fuel by 2030. Over the same period, the Chinese civil aviation administration has also set itself the goal of increasing the use of SAFs and reducing the intensity of greenhouse gas emissions. Based on the latest announcements, the production capacity of SAF in China could reach 1.4 Mt by 2030.

The price of SAF is one of the most decisive factors influencing its adoption, as fuel costs currently account for approximately 30% of aircraft operating costs for airlines. In 2023, the price of conventional kerosene averaged around $900 per metric ton. With the emergence of the SAF market, the first HEFA-SPK quotations have been recorded in Singapore, the United States and Europe, at around $2500/t in 2021, between $3000 and $3500/t in 2022, then dropping back below $3000/t in 2023.

![Tableau 4 - Prix annuels des SAF HEFA-SPK par grande zone de production [US$/t]](/sites/ifpen.fr/files/inline-images/NEWSROOM/Regards%20%C3%A9conomiques/Etudes%20%C3%A9conomiques/Biocarburants%202024/Tableau-04_TB-Biocarburants-2024.png)

Source: IFPEN, from Argus

**Class II: HEFA-SPK from recycled vegetable oils (UCO and POME), enabling a reduction in greenhouse gases of 85% min

The higher cost of SAF is therefore a prime concern that needs to be addressed through public policy incentives and technological improvements through R&I.

In terms of outlook, according to the “Net zero CO2 emissions roadmap” published in 2024 by the IATA, around 400 Mt of SAF will need to be produced every year between now and 2050 to enable emissions to be reduced by 65%. The remaining 35% would then be reduced through the development of new aircraft technologies (electricity and hydrogen) (13% of emissions), the development of new infrastructures and operations to improve energy efficiency (3%) and offset systems and CO2 capture solutions (19%).

The emerging role of biofuels in maritime transport

The emerging role of biofuels in maritime transport

In maritime transport, most ships in service across the world today use heavy fuel-oil, consuming around 280 Mtoe of oil-based fuel per year. The International Maritime Organization (IMO) has established regulations to limit the sulfur content of ship fuels. This limit was tightened in 2020, resulting in a 70% reduction in total sulfur oxide emissions from shipping. In addition, for several years now, players in the maritime sector have been calling on the industry to align itself with the 1.5°C trajectory of the Paris Agreement. Other recent highlights include the gradual evolution of on-board technologies, enabling ships to run on a variety of alternative fuels. In July 2023, the European Union adopted a new law stemming from the Maritime FuelEU initiative, aimed at reducing GHG emissions from the maritime sector (to -2% by 2025 and -80% by 2050), notably through using renewable, low-carbon fuels11.

Worldwide, the main alternative fuels under consideration today are biodiesels (FAME, HVO and (e)-BtL), biomethane (Bio-LNG), biomethanol, ammonia and their e-fuel synthetic versions (e-diesel, e-methane, e-methanol, e-ammonia). Preference is given to electrification and hydrogenation for dockside power requirements and river transport.

Today, the main alternative fuel to marine fuel-oil that is used is fossil LNG. In 2023, 355 LNG-powered vessels were in service and some 400 were on order worldwide. The pace has picked up sharply in recent years. The majority of LNG bunkering infrastructures are located in Europe, but all continents are now equipped (with a single port in operation on the African continent and in South America). Bio-LNG is still not widely used, but today it is available in nearly 80 ports around the world, including Singapore, Rotterdam and the East Coast of the United States.

In addition, the first marine biodiesel bunkering operations were carried out in 2022 in the ports of Rotterdam and Singapore, involving around 280 ktoe of blended biodiesel (FAME and/or HVO). In July 2023, the Maritime and Port Authority of Singapore (MPA) conducted the world’s first container ship methanol bunkering operation, during which around 300 metric tons of renewable methanol were supplied to the Port of Singapore for the first time. This means that by the end of 2023, a total of 558 kt of biofuels had been incorporated into maritime transport. According to the scenarios published by IEA Bioenergy and DNV12, biodiesel, bio-LNG and biomethanol will dominate the maritime biofuels market in this order by 2050.

Focus on France

Focus on France

In 2023, France incorporated a total of 3.5 Mtoe of liquid biofuels in the fuels distributed throughout the country, up 3.5% from 2022 and the highest level ever recorded. Most of these biofuels are diesel substitutes (2.6 Mtoe), followed by gasoline substitutes (0.9 Mtoe) and for the third year, biokerosene as a substitute for jet fuel (0.05 Mtoe).

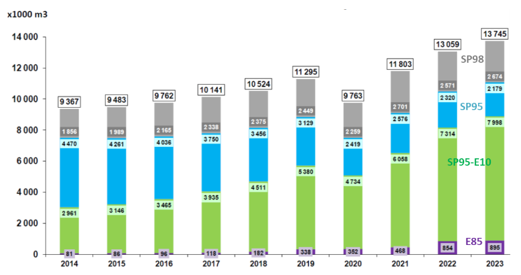

Since 2017, SP95-E1013, which contains up to 10% by volume of ethanol, has been the most consumed fuel by French gasoline vehicle owners, with a market share of more than 58% by the end of 2023. Super ethanol E85 (gasoline containing up to 85% ethanol by volume), dedicated to Flex-fuel vehicles and gasoline vehicles fitted with conversion boxes, continued its growth, with a market share of 6.5% of gasoline. The number of service stations distributing E85 also continued to grow. This fuel is now readily available in 40% of national service stations.

Source: Bioéthanol France 2024 from CPDP (French Professional Oil Committee)

Bioéthanol France estimates that a total of 250,000 gasoline vehicles will be equipped with E85 conversion boxes by the end of 2023, which represents an annual increase of 10%. The number of production Flex-E85 vehicles on the road rose by 44% to reach a total of 120,000 vehicles in 2023. Alternatives to gasoline also include a share of HVH-E14, which remains a minority but is gaining ground (5% of gasoline substitutes). With no mixing limits, this biofuel is not currently restricted by any specific indication at the pump.

In terms of fossil diesel substitution options, FAME and in particular, VOME15 continue to make up the majority (88% of the biodiesel mix). After a period of relative stagnation since 2020, the biodiesel market is on the up again, with a significant increase in the incorporation of HVH-G16 mainly derived from used cooking oils, animal fats and other industrial by-products that can be double-counted to meet regulatory incorporation targets.

Lastly, for biofuels, there is also a growing share of biomethane incorporated into NGV. In France, Bio-NGV is mainly consumed in the form of bio-CNG in road transport. In 2023, consumption amounted to 116 ktoe, up +26% compared to 2022. This means that bio-CNG accounted for 39% of total CNG consumption in 2023. The NGV fleet has grown the most in the heavy goods vehicle segment (+28% since 2022), with France’s NGV fleet being the largest in Europe (11,393 vehicles).

Lastly, regarding obligations to incorporate SAF in France, an incentive tax (TIRUERT17), as well as a 1.5% incorporation target, have been specifically defined in the 2024 finance law for renewable jet fuels. This rate will be increased to 2% in 2025, then 6% in 2030.

Outlook for carbon neutrality

Outlook for carbon neutrality

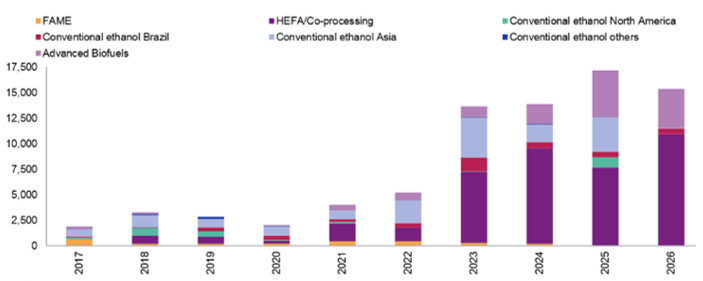

Investment outlook

After a period of relative stagnation, global investment in liquid biofuels is seeing a clear upturn, rising from nearly $5 billion in 2022 to over $13 billion in 2023 and matching figures in 2024, according to S&P Global. The majority of these investments are dedicated to developing HVO/HEFA production capacities (60%) as well as conventional ethanol (Brazil and India).

Source: S&P Global 2024

This means that HEFA/HVO production capacity could increase from 21 Mt in 2024 to almost 40 Mt by the end of 2026.

Investments in the FAME sector have slumped sharply, but are still going. For example, the EU is continuing to invest in the UCOME sector (Lithuania, Poland, and the Netherlands). Refiners in South Korea are also investing in the sector, due to a local mandate to incorporate biodiesel, as well as potential exports. India and the Middle East are also pushing ahead in their markets.

In addition to ethanol for road fuel, investments in ethanol for use as aviation fuel (alcohol-to-jet) are gaining momentum, primarily in the United States. Thanks to its demand for SAF, the aviation market is also spurring growth in the BtL sector (for its FT-SPK biokerosene), with several unit projects underway in the USA (see 2023 dashboard). In France, following an initial round of 5 publicly-supported projects aimed at carrying out feasibility studies for future SAF production sites in France, a new France 2030 call for projects is unleashing a further 200 million euros to support engineering work, with the successful applicants due to be announced in early 2025.

Internationally, in contrast to SAF, marine biofuels have yet to attract a significant wave of investments. Although the sector is set to take over as the outlook for road transport trends downwards.

A stronger position for biofuels in medium/long-term scenarios

A stronger position for biofuels in medium/long-term scenarios

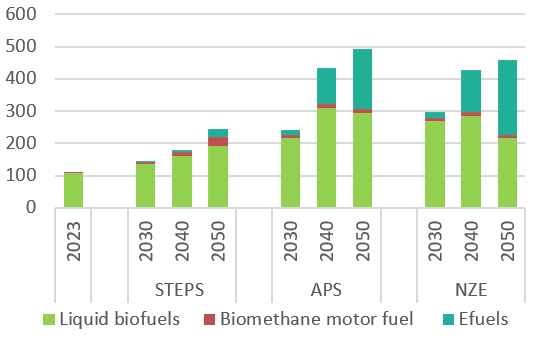

With the adoption of carbon neutrality goals being rolled out across all States, decarbonization solutions for emitting sectors are set to grow and diversify. For the transport sector, the main technological solutions are electrification, natural gas, hydrogen, biofuels and e-fuels (or electro-fuels). As each solution has its limits, most energy scenarios for 2050+ envisage rolling out all of these solutions, and especially biofuels, at different levels. A chapter dedicated to this subject has been included in the IFPEN 2023 dashboard.

Source: IFPEN from IEA, WEO 2024

The scenarios in the International Energy Agency’s World Energy Outlook (IEA, WEO 2024) all envisage growth in the biofuels market, with a minimum of 220 Mtoe (i.e. double the size of the current market) and a maximum of 320 Mtoe. Combined with the e-fuels sector, which can also mobilize biogenic carbon in its production chain, the market then extends to almost 500 Mtoe by the end of the timeframe, i.e. a penetration rate of almost 19% in the APS scenario and over 25% in the NZE scenario.

Source: IFPEN from AIE, WEO 2024

In France, at the end of 2024, a draft decree implementing the 2030-2035 Pluriannual Energy Program (PPE) was put out to consultation. In this draft version, additional incorporation of around 1 Mtoe is expected over the next five years (i.e. between 4.3 and 4.7 Mtoe in 2030), followed by incorporation of between 6 and 7.7 Mtoe by 2035 in all modes of transport. In the most optimistic scenario, the current market is expected to double over the next 10 years.

Daphné Lorne - daphne.lorne@ifpen.fr

[1] LPG: Liquefied Petroleum Gas

[2] NGV: Natural Gas for Vehicles

[3] B35: Road diesel made up of 35% FAME by volume

[4] UCOME: Used Cooking Oil Methyl Ester

[5] CNG: Compressed natural gas

[6] LNG: Liquefied natural gas

[7] HEFA-SPK : Hydroprocessed Esters and Fatty Acids – Synthetic Paraffinic Kerosene

[8] FT-SPK : Fischer-Tropsch – Synthetic Paraffinic Kerosene

[9] ATJ-SPK : Alcohol-to-jet - Synthetic Paraffinic Kerosene

[10] EASA : European union Aviation Safety Agency

[11] https://data.consilium.europa.eu/doc/document/PE-26-2023-INIT/fr/pdf

[12] Energy Transition Outlook 2024; Maritime Forecast to 2050; Det Norske Veritas, August 2024

[13] SP95-E10: Lead-free 95 gasoline containing up to 10% by volume bioethanol

[14] HVH-E: Huiles végétales hydrogénées de type essence (synthetic gasoline from hydrogenated vegetable oils)

[15] VOME Vegetable Oil Methyl Ester

[16] HVH-G: Huiles végétales hydrogénées de type gazole (synthetic diesel from hydrogenated vegetable oils)

[17] TIRUERT: Taxe Incitative Relative à l’Utilisation d’Energie Renouvelable dans le Transport (a tax to encourage the use of renewable energy in transport)